Bearer Instrument: What it is, How it Works

Such an instrument also allows individuals to hide large amounts of money in bonds, particularly money that is illegally made. An individual investor could previously buy any amount of bearer bonds they wanted, submit the coupons for payment, and remain completely anonymous. In 2009, the multinational financial services company UBS faced serious legal consequences. They paid $780 million in fines and agreed to a deferred prosecution agreement with the U.S. Justice Department, after they were accused of helping American citizens evade taxes using bearer bonds.

What Do I Cash In Old Bearer Bonds?

Then they have to try and figure out a way to exchange the bonds for their cash values. Those who practice organized estate planning might have attached all the proper bond documentation to their will, making it easier for their heirs to sort everything out. The Tax Equity and Fiscal Responsibility Act of 1982 effectively ended the practice of issuing bearer bonds in the United States. However, it took until nearly 2000 for the bonds to largely be removed from the U.S. financial system.

One Month After the Rate Cut: Where Are Annuity and Other Interest Rates Now?

Their popularity declined in the late 20th century due to concerns about tax evasion and money laundering. A registrar or transfer agent is responsible for tracking the name of each registered stock or bond owner. This ensures that bond owners receive all interest payments due and that stockholders receive their cash or stock dividends. It may be possible to purchase bearer bonds but that doesn’t make it a good idea.

What Is a Bearer Instrument?

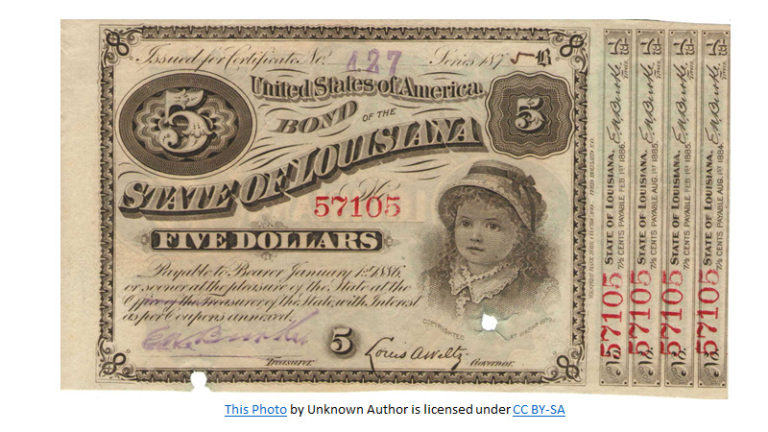

Governments and corporations have issued bearer bonds for several centuries, but they have become less popular in recent years. For example, bearer bonds were used extensively to finance the Civil War. However, changes in modern technology, the possibility of loss or theft and restrictions by government regulations have decreased their usage. Securities in bearer form can be used in certain jurisdictions to avoid transfer taxes, although taxes may be charged when bearer instruments are issued.

Create a Free Account and Ask Any Financial Question

Another provision of the law excused companies from honoring bearer bonds that were issued decades before. When a bond is sold to an investor, a certificate (the actual bond) is proof of that investment. When a bond matures, the investor may cash it in to receive their principle plus interest. Long-term bearer bonds value bonds can also pay dividends over the life of the bond according to the amount of interest accrued. If you have old bearer bonds lying around, you’re only hope might be to contact the company that issued them (if it still exists). You can also try to company that may have bought it or merged with it.

- The bond can be presented to the issuer at its maturity date for full redemption to receive the face value of the bond.

- Typical bonds consist of semi-annual payments costing $25 per coupon.

- When you buy a security through your brokerage and hold it in your account, that security belongs to you.

- Provide it with the serial number on the bond, and the company should be able to tell you the redemption value of your bond.

Corporate bearer bonds are issued by private companies to raise capital for various business activities. These bonds are typically used by corporations looking to finance expansion projects, acquisitions, or other significant investments. The anonymity provided by corporate bearer bonds can be appealing to investors who prefer to keep their financial activities private. However, this same anonymity can pose challenges in terms of tracking ownership and ensuring compliance with tax regulations.

This ensures that bond owners receive all interest payments due or that stockholders receive their cash and stock dividends. Each time a book-entry security is sold, a transfer agent or registrar changes the name of the registered owner. There are few real benefits to bearer bonds in the current age of digital securities ownership and trading. The clear and present benefit is that there are few barriers surrounding them. If you’re in possession, you have the right to the coupon payment or redemption value. Bearer bonds are a special type of bond that isn’t registered to any particular person.

Despite these precautions, the inherent risks of dealing with unregistered securities can never be entirely eliminated, making bearer bonds a less attractive option for many financial institutions. The post-war period saw a continued reliance on bearer bonds, but the landscape began to shift as financial markets became more sophisticated and interconnected. The rise of electronic banking and advancements in financial technology introduced new ways to manage and transfer assets, reducing the need for physical bearer bonds. Additionally, the increasing complexity of global finance brought about a greater emphasis on transparency and regulatory oversight.

You are required to read the offering statement filed with the SEC before purchasing any bonds. This website must be read in conjunction with CREB’s offering circular in order to fully understand all the implications and risks of an investment in CREB. Any references on this website to past results should be read with the knowledge that past results are not indicative of future results.

Anyone who provides the necessary coupons to the issuer can receive the interest payment regardless of whether that person is the actual owner of the bond. For this reason, coupon bonds present a lot of opportunities for tax evasion and other fraudulent acts. Bearer bonds are still legally traded in the U.S., but regulatory and law enforcement agencies keep a close eye on issuances and transfers of these instruments to curb illegal activity.