Real Estate Accounting: A Complete Guide for 2024

When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility. Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. You can connect with a licensed CPA or EA who can file your business tax returns. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice.

What type of Accounting is Used in Real Estate?

A real estate account takes responsibility for the financial aspects of the buying, selling, leasing, and renting of real estate properties. Also known as property accountants, this position also plays an important role for preparing documents for tax season. Real estate accounting is the typical term for accounting practices focusing on real estate transactions. This type of accounting practice looks at the revenue generated by various properties and the following tax requirements. We looked at the fundamentals of real estate accounting and then moved to discussing the differences between accounting and bookkeeping.

Tenant Resources

Due to an oversight, a significant financial discrepancy was discovered in the records of a recently closed deal. The mistake threatened not only the agency’s reputation but also the trust of our clients. The Premier Plan offers all the features of Deluxe as well as analysis tools that help you make the most of your investment portfolio. The Deluxe plan will allow you to connect to your credit cards, loans, investments, and properties. It assists with financial planning allowing you to create a road map for loans, investments, and retirement.

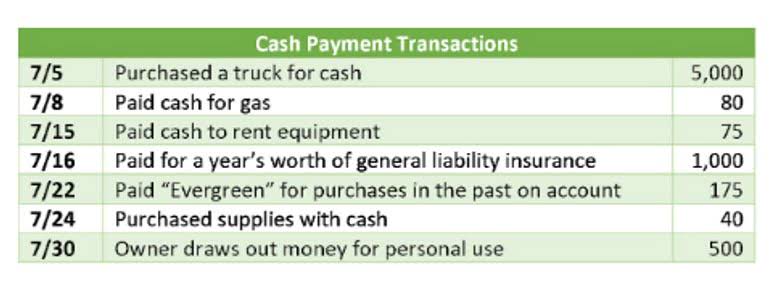

Itemize All Incoming and Outgoing Transactions

Bookkeeping also creates documentation, financial documents, and a paper trail in case the company is audited. Shoeboxed can help real estate agents simplify bookkeeping, save time, track accurately, and focus on what they do best—assisting clients in buying and selling. Another great feature for real estate agents is its seamless integration with accounting software like QuickBooks realtor bookkeeping and Xero for easy data transfer and sync. Most real estate agents use cash-based accounting because of its simplicity and tax benefits. This simple method gives you an accurate picture of your “in-the-moment” cash flow. With cash-based accounting, you can feel relieved knowing you don’t need to be a financial expert to manage your business’s finances effectively.

- A solid accounting system helps keep track of potential deductions, like mileage, home office expenses, and marketing costs, ensuring agents don’t pay more tax than necessary.

- If you were questioning if real estate professionals really need a bookkeeper, sure enough, the answer at this point would be a “yes!

- The lender computes the amortisation schedule when you borrow money to buy a property, detailing the repayment plan.

- Once you have your operating costs sorted in your accounting system, you can take steps to track all of your business expenses.

- QuickBooks Online Accountant is a program that trains accountants on proper accounting practices as well as business health and growth.

If you have no experience, you likely need software with more live customer support options and a lower learning curve as expressed in user reviews. Not providing clear descriptions of expenses can make them hard to justify as business-related. Detailed mileage reports can be generated to track and claim mileage deductions. https://www.bookstime.com/articles/1099-vs-w2 With Shoeboxed, receipts are stored in an IRS-accepted format, making tax preparation smoother and more audit-proof. Pramod has over 11 years of experience relating to finance and accounts in diversified industries. He is an expert in resource and process optimization resulting in greater operational efficiencies.

- A reliable bookkeeping service empowers you to make informed budgeting decisions, freeing up valuable time to focus on running your small business.

- You now have $200,000 less in cash, but a significant asset worth that amount.

- Conducting reconciliations monthly can help maintain financial integrity and provide peace of mind.

- It provided us with real-time visibility into financial data, enabling them to track expenses, commissions, and overall profitability with ease.

- Join over 25,000 US-based business owners who have streamlined their finances and have grown their businesses with Bench.

Separate Personal and Business Finances

Real estate agencies can use real estate accounting software options to manage their accounting deals and real estate deals effectively. Many real estate companies also integrate property management software into their accounting platform to meet their bookkeeping needs and comply with real estate tax laws. This can help business owners make informed decisions and improve their financial management. Real estate agents can also benefit from accounting and bookkeeping features that cater to the specific needs of the real estate industry.

- By providing your tax professional with tax-ready financial statements, you’ll make their job much easier and reduce the number of billable hours they charge to you.

- The accrual method recognizes income when it is earned, regardless of when the payment is received.

- From financial visibility and compliance with regulations to informed decision-making and efficient property management, the benefits of maintaining accurate financial records are far-reaching.

- A good real estate bookkeeping system automatically creates a paper trail so that if an investor is ever selected for a tax audit, back up information to verify all income and expenses can easily be found.

- This level of detail creates a financial narrative that can help real estate professionals understand the nuances of their investments and identify opportunities for cost savings and enhanced revenue generation.

Real Estate Accounting – 7 Things Agents NEED to Know (2024 Updated)

Its $10 per month Sage Accounting Start plan offers the ability to track expenses, create and send invoices and reconcile bank accounts. Its Sage Accounting $7.50 per month plan (current promotion) includes receipt capture tools (free for three months), unlimited users, quotes and estimates, cash flow forecasting and invoice management tools. With real estate bookkeeping-specific software, real estate agents can have their own real estate accounting system and track almost everything they need in one place. Real estate accounting and financial reports show exactly where a real estate company stands financially.

The Imperative of Real Estate Bookkeeping in Today’s Market

- For instance, let’s examine a property valued at Rs 1 crore with a 20% down payment and a 10% interest rate over 20 years.

- This simple method gives you an accurate picture of your “in-the-moment” cash flow.

- It doesn’t matter whether you sell a dozen houses this quarter or none—you’ll still need to pay the flat marketing fee.

- You can email custom invoices with payment links and simplify and track your business deductions and profit and losses.

- Proper bookkeeping is crucial for real estate investors, landlords, property managers, and real estate agents to stay organized, make informed financial decisions, and comply with tax regulations.

If all of the information about real estate accounting processes overwhelms you, don’t despair! Having separate checking and savings accounts for your business makes connecting them seamlessly to your accounting software or platform easier. Doing so can relieve an extra step or manual work for you and your accountant. Understanding the division between bookkeeping and accounting gives you more confidence and helps you know when to delegate tasks to other professionals in these crucial areas. While this doesn’t require complete knowledge of everything there is to know about financial management, it does require a willingness to learn, make changes, and stay on top of essential accounting tasks.

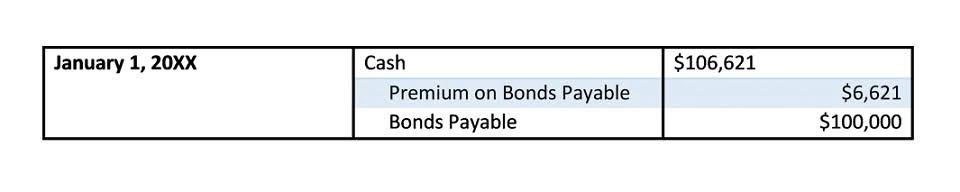

Disposal property

This reduces errors, eliminates duplicate transactions, and improves the likelihood of balancing your books. The double-entry method allows you to process the purchase with a single entry and effectively verify that the debits and credits are in balance, preventing errors in any accounts. A good real estate bookkeeping system automatically creates a paper trail so that if an investor is ever selected for a tax audit, back up information to verify all income and expenses can easily be found. The expertise and dedication of GRG’s leadership has lead to its ownership and management portfolio of about $350M in assets/2500 rental and commercial units throughout the New York Metropolitan area. As a full-service Property Operations and Asset Management firm, GRG also provides services for all new construction projects, moderate building rehabilitations and capital improvements.