In the housing sector, real estate sales volumes have dropped significantly and rapid increases in unemployment have added uncertainty to many transactions, forcing mortgage brokers to stay nimble in the face of new challenges and constant change. To ensure business continuity, mortgage brokers have adapted to the new virtual-first environment, which has revealed an urgent need and opportunity for the broader industry to adapt with them. The existing homebuying process is being left behind, and lenders need to consider technology’s role in making the mortgage origination process more efficient, agile, and digitally secure.

The Digital Homebuying Experience

Tech-forward companies like Amazon, Uber, and DoorDash have transformed the way we buy goods and services. Our expectations now operate at a baseline of “this should be simple, accessible, and efficient”, so much so that 75% of Canadians expect companies to remove all friction around purchases. Nowhere is this more true than the mortgage industry, given the financial implications to a buyer with mortgage-related decisions.

During this global pandemic, digital experiences like virtual appraisals, remote closings, e-signatures and cloud-based document sharing became must-haves, not just nice-to-haves. Delivering a digital and optimal buyer experience is going to become the industry standard and brokers need to be proactive in seeking out technology to help them do that.

For instance, Lendesk’s Spotlight Search compiles all lender rates and policies into one place and updates it daily. This digital tool removes the manual work and the friction that used to be required when it came time to source and present the best package for a client. In light of COVID-19, Lendesk has lifted the paywall to one of its policy features so that all mortgage brokers across Canada have real-time access to the changing policy and lender information as it relates to COVID-19.

Connected Digital Security

The Facebook-Cambridge Analytica data breach in 2018 brought the topic of data security and privacy to mainstream news. Clients are asking questions about their data, and 51% are nervous about the hacking of financial or personal information online. Regrettably, the mortgage industry recently experienced the effects of ransomware attacks on one of our key platforms. This disruption caused an industry standstill with thousands of mortgage applications being delayed.

The industry needs to be accountable for their client data and practices. Many financial institutions adhere to SOC2 compliance practices, but the rest of the industry needs to be held to that same level. Brokers need to be proactive in asking themselves the important questions surrounding their client data – is it secure and who owns it.

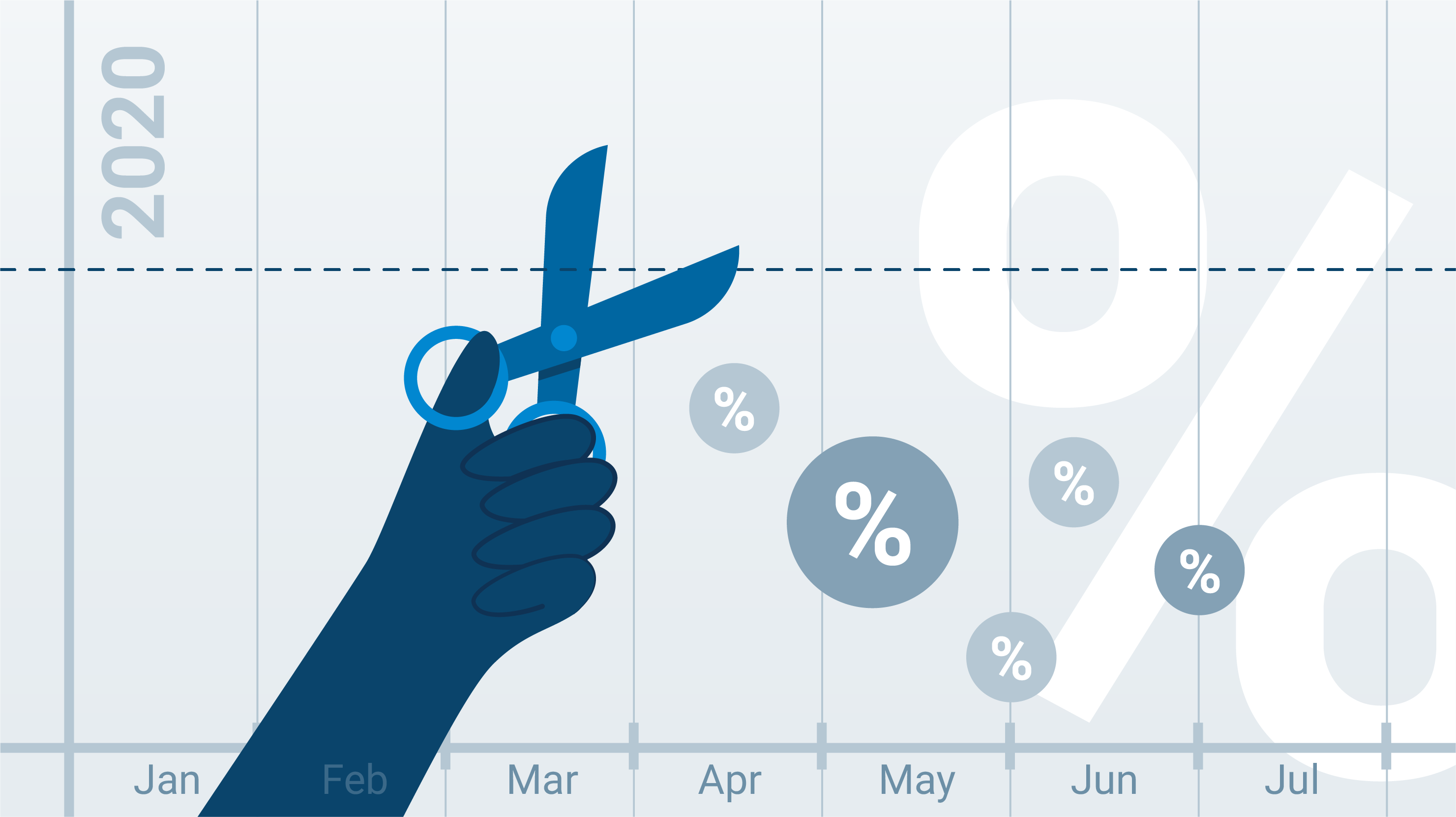

The push towards increased digital security will become even more transparent on July 1, the date cited by Equifax for major industry change. We’ll see Equifax mandating that all credit score enquiries be posted with both broker and lender names showcased, on all industry connector platforms. Additionally, Filogix announced it will be shifting towards turning off PDF export capabilities. The need for digitally secure and connected platforms is more important now than ever.

Gaining the Competitive Digital Advantage

Those that have invested in technology have a competitive edge over those that haven’t when it comes to delivering a high standard of buyer experience.

The benefits are numerous, as technology makes for a more efficient and streamlined process. Adoption of APIs, in particular, may initially seem overwhelming, and can be dismissed under the assumption that it’s cumbersome to set up. But with “code-less” tools like Zapier, APIs are easier to leverage than ever before and can provide teams with a competitive advantage. We need to prioritize a digitized and connected mortgage process and engage with providers that can help connect our systems.

Canada’s mortgage industry is shifting, and the pandemic has highlighted the significant opportunities we have for improvement as we look to deliver the next generation of consumers the experience that they expect and deserve.

—

Alex Conconi,

CEO of Lendesk